Did you know that if you have $100k invested by age 35, you’ll retire a millionaire by 65 without adding a penny more?

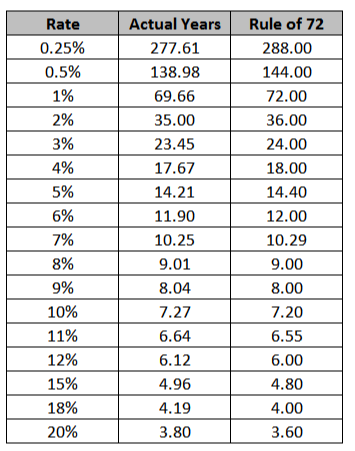

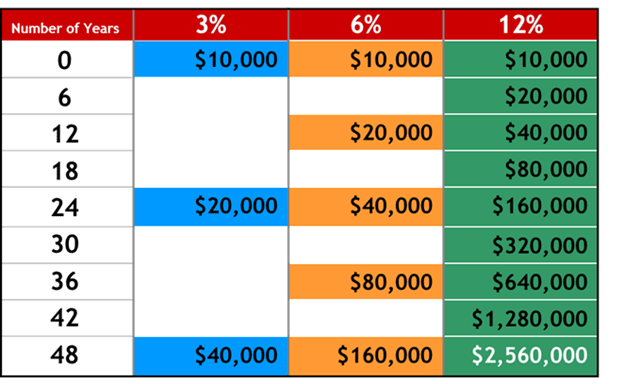

That’s because of something called the rule of 72, which is a quick mental calculation you can use to estimate how long it will take for an amount to double. You’d divide 72 by the interest rate to get the number of years.

Notice the actual number of years is not exactly 72/r, but it’s close enough to be useful in finance.

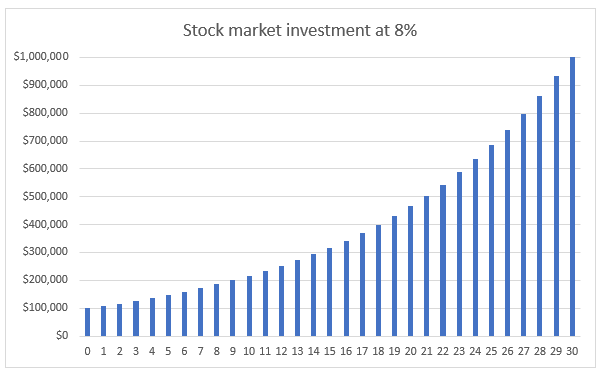

The stock market has historically returned about 8% a year, so if you had $100k invested, it would take about 9 years (72/8 = 9) for your investment to turn into $200k. Another 9 years would yield 400k, and on the third 9 year period, that would double to $800k. And so on.

The shorter the time it takes the amount to double, the more doubling periods you can squeeze into your timeline.

This works for investing as well as debts. A credit card charging you 24% will take just 3 years to double. This is why it’s so important for you to get out of high interest debt as soon as possible.

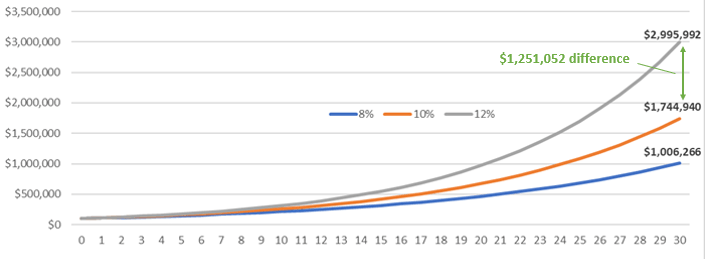

The higher the interest rate, the faster the money compounds. A 10% return would double your money about once every 7.2 years, meaning you’d reach $1 million in 24 years instead of 30.

If you earned 8% for 30 years, you’d have a million. At ten percent, 1.7 million, and if you managed to get 12% a year, you’d be able to grow that $100,000 to 3 million after 30 years. With no further input on your part. This money would grow and compound whether you were working, sleeping, or watching TV.

However, notice how big difference in final balance between 10 and 12%. An annual gain of just 2% more ends with a final balance 72% larger! Even small reductions in your yearly returns can reduce your final balance by massive amounts. This is one reason I always invest in funds with low expense ratios; high fund fees can decimate your returns, and why I like low-cost index funds, such as Vanguard’s Total Market Index Fund (VTSAX, ETF: VTI). It has an expense ratio of just 0.04%. Compare that to a more actively managed mutual fund, which traditionally costs 1-2% of your account balance every year, even if you lost money!

Going back to the initial example of $100,000 at 35, if you think 30 years is a long time to get to $1 million, just remember: anything invested on top of that initial 100k will just get you there sooner. Time in the market is your friend, so start saving and investing as soon as you can. Set something aside for your future every paycheck.

Good info folks should invest as early and as much as possible!

LikeLike