Disclaimer

Let me start out by saying that this is in no way meant to imply that I have found the secret to stock picking. Nothing I say here should be taken as an investment recommendation, and anything you do with your investments is at your own risk. (Disclaimer over)

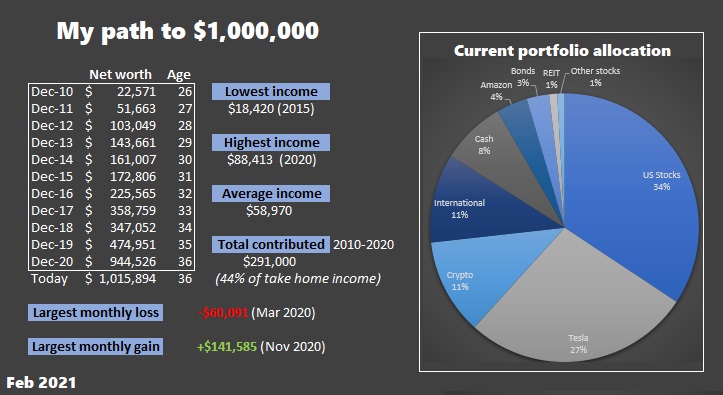

Summary for the lazy members of the audience

Here’s a summary in case you didn’t want to read my life story:

– I spent less than I made and invested the difference

– I prioritized saving and set aside part of every paycheck

– I invested in stock index funds (an example is VTSAX), then when I had over 200k, I put 10% of my portfolio into single stocks and other side gambles. Most notably TSLA, AMZN, and BTC

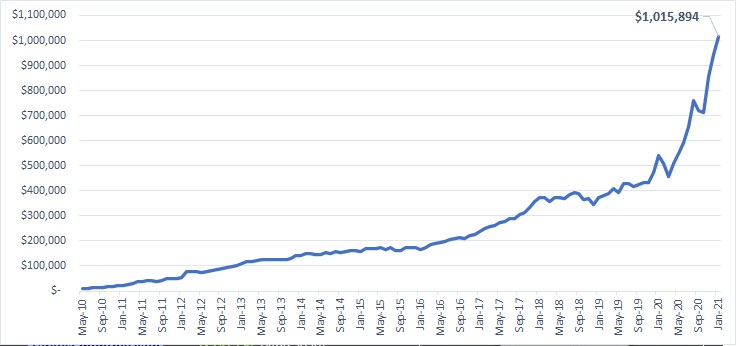

– I reached half a million in January of 2020

– My side bets blew up in 2020, pushing me past $1 million a few days into 2021

– I got lucky with my picks; you might not have the same luck, so your best bet is to have a simple diversified portfolio, contribute regularly, and tune out the noise of market fluctuations

The Details

In 2010, I got out of debt. It was three months before my 26th birthday, and I was ecstatic to be reaching zero net worth. I’ve been frugal most of my life, initially out of necessity (growing up poor), then by choice.

When I was 21, I joined the military with about 4,500 of credit card debt, and I added another 20k to that with the purchase of a brand new car. However, for the first time in my life, I had a stable job with decent pay, and I leveraged that to save money, aggressively pay down my debt, and started contributing to my Thrift Savings Plan, which is a 401(k)-type retirement plan offered to government and military employees. At the beginning, I could only contribute $90 a month because I still had debt. But I made it a point to save part of each and every paycheck. I prioritized saving, knowing that having enough money was my ticket out of the stresses of poverty.

Four years later, I was debt-free, and able to invest even more money. The last four years of my military service, I saved half my income. Roughly $30,000 a year. Two years and nine months after getting out of debt, I had my first $100,000. I left the military at 30 years old with $150,000

It took me four years to climb out of $25,000 debt, and only another four to reach $150,000. The reason for this is because when you’re in debt, the interest is working against you, and when you are investing, it’s working for you. Similar to a rowboat on a river. Debt is like rowing upstream, where your effort is stolen by the current, and investing is the opposite. The current helps you along, beyond your own efforts.

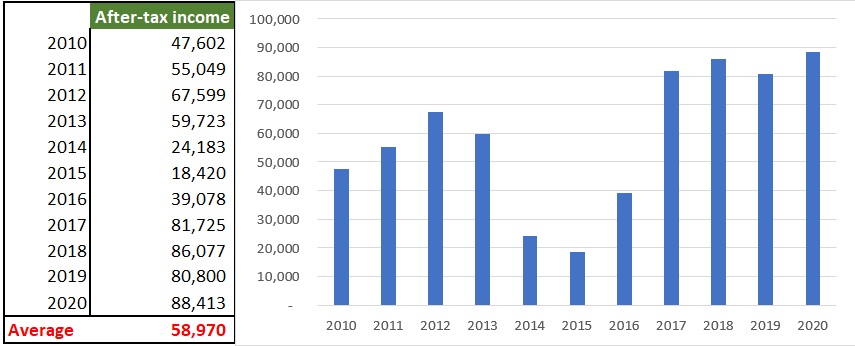

Life after the military was hard. After seven months of job hunting, I found a manual labor job at UPS which paid me $10/hr. I was bringing home around $1,000 a month, but I was determined to make it work. I only made $18,000 in 2015, but since saving has always been a priority for me, I was able to save about $800 that year!

At 31, I was promoted to supervisor at work in the UPS warehouse. My income doubled, and as soon as I could, I opened a Roth 401k and started contributing. 10% at first, going all the way up to 35% once I saw I could cover my basic necessities with less.

Between 2010 and 2020, I made an average after-tax income of about $59,000. Notice I had not a single six-figure year. Yet I built a seven-figure portfolio in a little over a decade simply by saving part of that income and investing consistently.

At 32, I started receiving a tax-free housing allowance of $2,400 under the GI Bill while I went to school. Most people would view that as a spending opportunity to maximize their lifestyle, but I viewed it as an opportunity to invest more money. That allowed me to bump up my 401k contributions to 50% of my pay, as well as max out my Roth IRA each and every year.

Thanks to the power of compounding over time, $51,000 contributed to my TSP is now worth $98,000, and $61,000 of cumulative contributions to my Roth IRA is now worth $133,000.

What I invested in

From the start, I invested in stock mutual funds, settling on index funds due to their low fees. I had looked into the success of stock traders, and I was not impressed with the results. I wanted something I could set and forget, and figured a passive investment method that was historically guaranteed to work over a long timeframe would fit me best. After I had accumulated $200,000, I decided to allocate a small amount (10%) to speculative investments and individual stocks.

If you want to speculate, do so with your eyes open, knowing that you will probably lose money in the end; be sure to limit the amount at risk and separate it completely from your investment program

Benjamin Graham, The Intelligent Investor

I knew I had no stock picking skill, nor did I have an appetite for risk, so I set aside an amount I was comfortable gambling (i.e., possibly losing some or all of it).

I got pretty lucky with a couple of my picks. In 2013, I bought Amazon. In 2015, Tesla. In 2016, Bitcoin. There were also a number of other unsuccessful stocks I bought, which I have since sold. There was no skill or secret involved in these picks. I didn’t even do any research. I liked Tesla cars, so I bought stock in the company. I figured Amazon would be around for a while, so I bought that. I saw the buzz around crypto and decided to put $1,000 into bitcoin as a gamble when it cost $450/BTC. If it made money, great; if not, oh well, I’m out a grand.

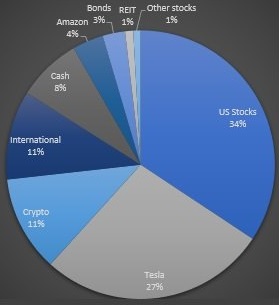

I set aside 10% of my portfolio to be invested in side bets, the remaining 90% in diversified index funds, but the side bet money has now ballooned to about 45% of my portfolio due to the recent success of BTC and TSLA.

Anyway, last week, my net worth crested the mythical seven-figure mark. Double comma club. One meelyon dollars

So to recap, I prioritized saving from a young age, got out of debt at 25, continued living frugally so I could save more money, invested it in index funds, and later in individual stocks, and today at 36, despite never making a ton of money, I am a millionaire.

Now, I will admit that this long stock bull run has helped me quite a bit. At some point in our lives, we will probably experience a prolonged period of flat or negative growth, similar to the 1970s, so there’s no guarantee that you will be able to replicate my numbers in the same timeframe. However, you will benefit from learning to live on less, saving more, having a long term mindset, and putting your money to work for you.

My current allocation

I’ve always been a buy and hold investor. I ignore market fluctuations, and I do not sell. As of today, this is how my investments are split. Many people have told me I should sell some of the Tesla and bitcoin because they make up such a large portion of my net worth, but the idea was always to put a little bit of money in them, and let it ride. I plan to continue on this path, until my net worth pushes me past my FIRE number (currently around $3 million), at which point I will reconsider and likely sell most or all of the side bets. Of course, the value could disappear tomorrow, so I’m not super attached to these investments.

Shameless plug for my financial coaching class

The only way I was able to do what I did here was because I developed strong money habits, which are the foundation for everything. I prioritized saving and investing over spending, and it served me well. If you or someone you know would like to speak with me about getting your financial house in order, getting out of debt, creating a budget, and much more, please contact me for a personalized money coaching session. My goal is to prepare you with tools that will take you to financial independence and beyond.

congrats on your 1kk, they say the first is the hardest 🙂

LikeLike