I became a millionaire at age 36 in one of the most boring ways you can imagine. I’m a W-2 employee. I worked a job, saved part of every paycheck, and contributed to my retirement accounts. That’s pretty much it. Many people think success with money comes from big events or one-time lucky wins, but the reality is that financial success is built on a foundation of good financial habits. Ever since I first made money, I made it a habit to save some of my income. That helped me live within my means, no matter how much I made, and there were times when I was not making much, but I still saved some of it. Living on less than I made allowed me to save some money, avoid debt, and invest the savings into the stock market.

Even as a millionaire, I still live in a 1 bedroom apartment. I really don’t need anything bigger right now. My car is a 2007 Corolla with almost 260,000 miles on it. It still runs reliably, and I really don’t need another one just yet. Travel light.

I keep things simple in life and in investing. I work 40 hours a week and do what I want the rest of the time. I don’t do leverage. I don’t do debt. I’m not one of those entrepreneurs trying to sell you a course on TikTok. I don’t own a business of any kind. My one-on-one financial coaching sessions are the closest thing to a side business that I have, though it’s more of a hobby than anything. I don’t do dropshipping, or AirBnB, or day trading, or options. I don’t do LLCs or IULs or tax write-offs. I don’t do rental real estate, a big house, or a Lamborghini. I don’t have a Rolex, an Audemars Piguet, or a Richard Mille.

I don’t do complicated in life, or in investing. I keep it simple.

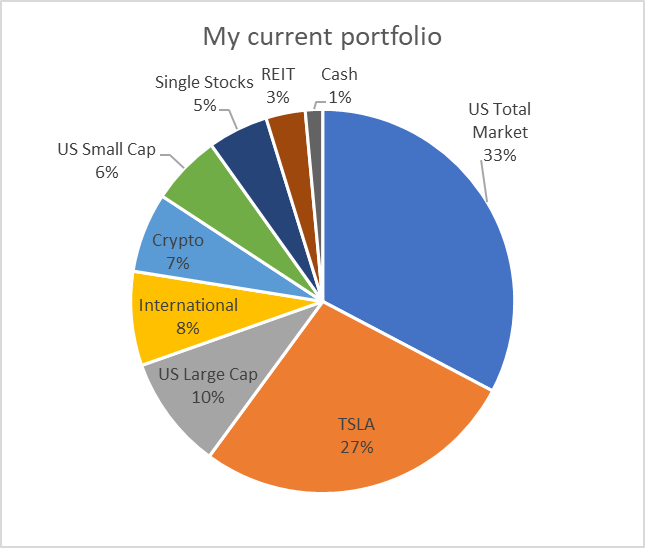

My core investing belief is that regular people should avoid stock-picking and instead invest in low-cost index funds. The way I do it is not exciting, but it is effective. I live simply and I invest simply, because I know those are the sure ways to wealth.

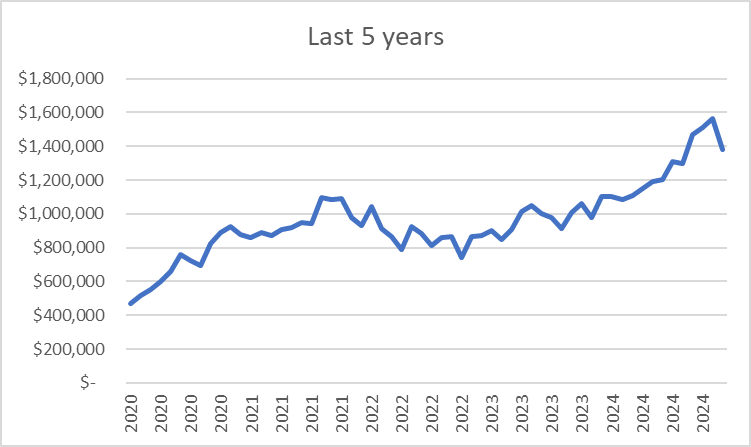

That’s not to say you can’t have a little excitement. At a certain level of net worth, it’s ok to risk a bit. When I reached $200,000, I put about 10% of my portfolio into several single stocks and riskier investments. I got very lucky with a couple of these, notably Tesla and Bitcoin, but most of my contributions have always been to index funds. And it has paid off: