July 7, 2023

Chronicles of the sort-of-wealthy but kinda broke:

I am going to see how long I can make it before I have to draw money from savings to pay the bills. A big tuition bill for my wife’s nursing school in May caused me to go into credit card debt I couldn’t immediately pay off for the first time since 2010.

The difference between 2010 and 2023 is that now I have a solid cash emergency fund and a bunch of stocks I can liquidate quickly if I really had to. I’m still nervous about debt, but I can now wipe it out if needed.

Saving money has always been a priority of mine, which differs from the more common spending priorities of bills, then ‘wants’, and then, if anything’s left, maybe savings and investments. Or even worse – Wants first, then bills, maybe?

Not me. The first dollar that comes out of every paycheck goes to savings. Then the bills/needs, then if there’s anything left over, for fun. Debt doesn’t suit me, as it takes away from my ability to allocate part of my income toward investments, and I don’t like owing people. It’s on my mind constantly until it gets repaid.

So imagine my chagrin when I found my bank balance bumping along in the double digits for a perilous few days several times last month, and my credit cards having balances I would have to carry over. I was nervous, to say the least. I can’t stand being in debt.

But I engineered a revolving automated excel spreadsheet to calculate out my bank balance over the next month, taking into account incomes and expected outflows (recurring expenses and expected credit card payments), and now I don’t feel so nervous anymore because I can forecast out into the future. It’s turned into a game. I’ll see how long I can make it before having to declare defeat and pull some money out of savings.

I’m lucky to be able to turn other people’s nightmare into a game, like the billionaire who works a menial job for a thrill. There’s never any real danger, because at any point, you can bail.

Save your money, and one day it will save you.

Think I’ll make it past August 7th? Tune in next month

The millionaire next door has $5 in his bank account.

June 13, 2023

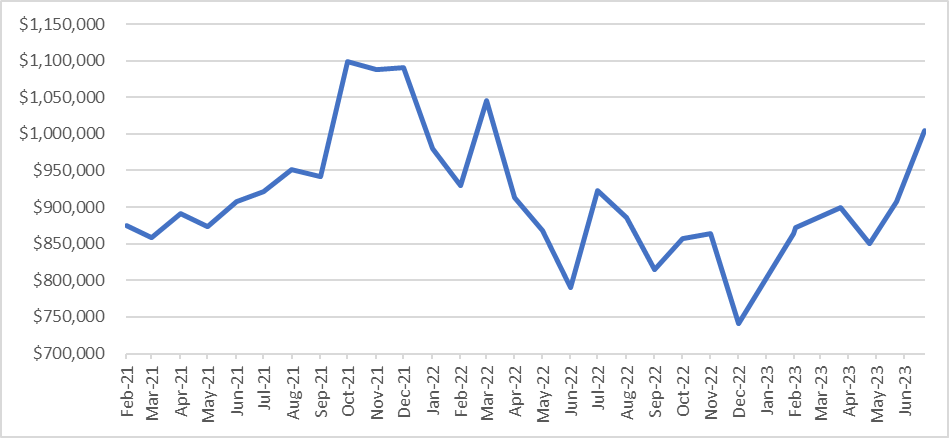

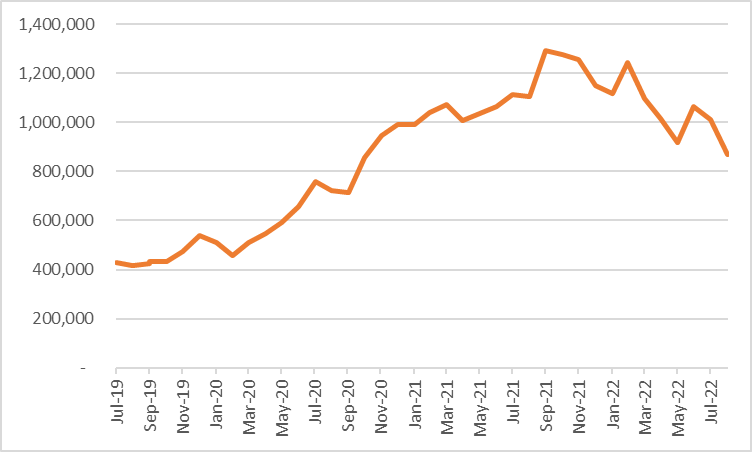

Hooray! Thanks to this market, my portfolio is once again over $1 million. Inflation means the million I have now is worth less than it was in 2021 when I first reached $1 million, but I think the worst may be over and it’s up from here.

Unemployment is low, inflation is starting to subside, and a dozen eggs are once again going for $1.29 at my local Aldi, so the market has seen fit to boost the S&P 500 by 15% YTD.

Elon Musk is handing the reins of Twitter over to an advertising executive from NBC Universal, and Tesla may become the universal charging port used by EVs everywhere, as Ford and GM will be using Tesla chargers for their cars. For these reasons and likely a lot of others, the stock has been climbing for the last 13 sessions, and the stock is up over 100% YTD. The $13k my wife and I used to max out our 2023 Roth IRAs with, is now worth over $26,000.

Lot of 13s. Weird. It’s also Tuesday the 13th today, which is the Spanish equivalent of Friday the 13th. No luck, just an interesting coincidence.

January 2023

The market was up 6.2% and Tesla soared 38%, growing our portfolio by $116,000 for the month

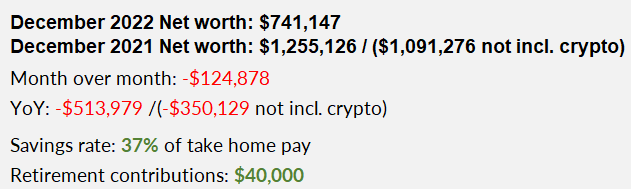

End of 2022

Retirement breakdown: 2x Roth IRAs at $6,000 each, HSA at $7,300, and Roth 401k at $20,500

This was a pretty bad year for investors. The S&P 500 dropped by 19.4%, TSLA and bitcoin both dropped by about 65%. The crypto sector essentially collapsed, and many companies were revealed to have shady business practices and to have misused investor funds. My own crypto was being held on the Celsius platform, which paused withdrawals mid-2022 (never a good sign) and then filed for bankruptcy shortly after. A judge recently ruled that when investors put their money on the platform, they handed over ownership of those assets to Celsius and most people had no claim to the money.

In short, the money’s gone. While these bankruptcy proceedings may end up distributing something, I’m not holding out for anything. That’s why you see two numbers under the Dec 2021 value and year over year loss above.

Anyway, the good news is that the market crash has helped to shake out some of the bubble insanity we’ve been seeing the past few years. Stocks were (and some say still are) much more expensive than they should be. Even if you don’t believe that, there’s no denying that real estate is way too expensive. A home should cost no more than 4 times your annual income, so it makes sense that the average American home should cost no more than about 4x the average income, but in general, that is not the case. In some places, the average home is 10x the average income or more. This broad market crash has helped reduce some of those prices and we are seeing things come back down somewhat.

The stock bubble, real estate bubble, crypto bubble, NFTs, they were all a direct result of the Fed printing way too much money and that money not having anywhere to go. This is especially evidenced by the correlation of interest rates and the timing of when the market started going down. This crash has helped remove some of the air and brought values back down to earth.

I don’t know what 2023 holds. I’m fairly optimistic over the next 5 years, but for me, there’s about a 50-50 chance that the market will be positive this year. In the meantime, I will continue taking advantage of these lower prices and buy more. I changed nothing about the way I invest this year. When the market went down, I didn’t sell or change my asset allocation. It pays to be always invested because the market rebound can happen fast and will not be announced in advance. Stay invested!

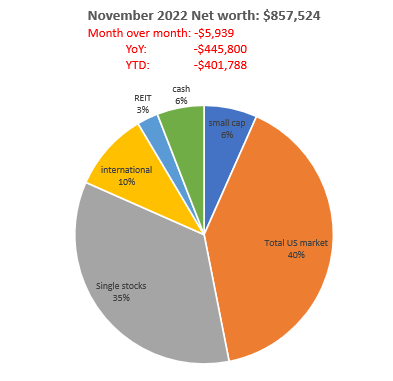

November 2022

Not much has happened this month. The market is still bouncing around -20% for the year. The longer we are in this bear market, the more comfortable I become with the unrealized losses, and the happier I am to see my investments down. Remember that the only time you want the market to be up is when you retire and sell your investments. You want it to be down for as much of your accumulation phase as possible so you can get more for your money. Since I am still well within my working career, in a job I don’t mind, and have no intention of retiring soon, lower prices allow me to buy more than I would have otherwise. Tesla is dropping like a stone due to Elon Musk’s involvement with Twitter, and I am watching the drop with some glee. I need another 40 shares to round out a goal I’d set for myself (1200 shares between my wife and my portfolios), and it’s looking like we may be able to buy them all with next year’s Roth IRA contribution if the price drops another $15 per share.

I am down almost half a million dollars from last year’s peak, and while there’s many a sharp intake of breath when I reveal this to people, I follow it up with “but I still have over $800,000, which is not bad”. I don’t need the money yet, who cares what the current price is?

On the crypto front, I’ve been getting periodic updates from the law firm handling the Celsius bankruptcy, and I may end up getting something back. We shall see.

October 2022

It’s been almost a year since my last blog post. I’ve been wanting to post net worth updates and brief thoughts but didn’t want to flood the website with useless posts. Then I realized I can keep all the updates in one post by continually updating. So here we go…

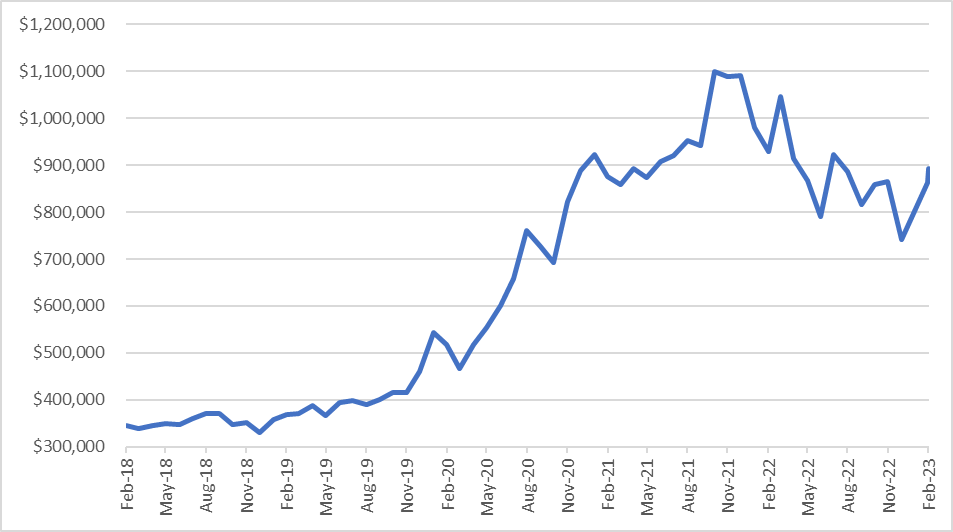

In January of 2021, I became a millionaire. It was a bull market, everything was going up, and the gains were inevitable. My retirement accounts were growing, the bitcoin I’d bought for $1,000 in 2016 was worth $150,000, and retirement was in sight. The market continued cooperating through the end of the year, when the net worth clocked in at a hefty $1,255,000.

Then the Fed raised interest rates, and everything crumbled. Businesses had borrowed money at such low rates that allowed future profit expectations to be highly inflated, and so were asset prices. The abrupt interest rate hikes were the pin that popped the balloon filled with over a decade of 0% interest loans. So everything dropped. Stocks, bitcoin, even real estate, just a little.

To add insult to injury, I lost access to my entire cryptocurrency portfolio. Celsius, the platform where I had held all of my crypto, paused withdrawals and filed for bankruptcy and I could no longer withdraw the money. I wasn’t too upset about the bitcoin – after all, I’d only spent $1,000 and knew it was pure speculation – but I put $20,000 of real money into USDC because Celsius was paying 10% at a time when banks were paying 0.5%. The bankruptcy is still ongoing, so I may get some of it back at some point, but I expect nothing.

At the end of September, the value of my assets was $867,000, an almost $400,000 drop from the peak. More than that if you don’t include contributions. That’s a lot, but it doesn’t really bother me. I still have decades of working years ahead of me, plenty of time for it to recover. Besides, the current value is still a healthy amount higher than 3 years ago.

Two positive things:

- I’ve had a stable job all year and contributed the max to all of my retirement accounts (Roth IRA x2, Roth 401k, and HSA – total of $40,000). Since the market dropped, my contributions have bought 20-30% more shares than they would have if the market had stayed high

- I still have 4,200.69 DOGE on Robinhood that wasn’t affected by the Celsius BS. Maybe it’s going to be worth something someday, if Papa Elon has anything to do with it