Again, the obligatory disclaimer that I am not an investment adviser, and anything you do with your money is at your own risk. Investments carry with them the risk of losing money, sometimes all of it. Past performance may not equal future results.

Everyone is different, and everyone’s investing strategy is different. The majority of you probably don’t care to do too much research; finance and investing are not really your cup of tea, and you just want something you can set and forget, that will get you to retirement. That’s what I’m laying out for you here.

The following suggestions assume you have paid off your debts and have an emergency fund, with a savings gap that allows you to put some money away. This is is very important, so I will repeat myself, in larger letters this time: DO NOT INVEST UNTIL YOU ARE OUT OF (high interest) DEBT. It does you no good to earn 10% in the stock market or 5% in bonds if you’re still paying 20% on your credit cards.

For people in all stages of life

- Take advantage of tax free accounts like IRAs, HSAs and 401ks. Max them out before investing elsewhere

- If you qualify for the Roth version, choose that over traditional

- Invest in funds with low expense ratios

- Never use debt to invest. (except maybe for real estate)

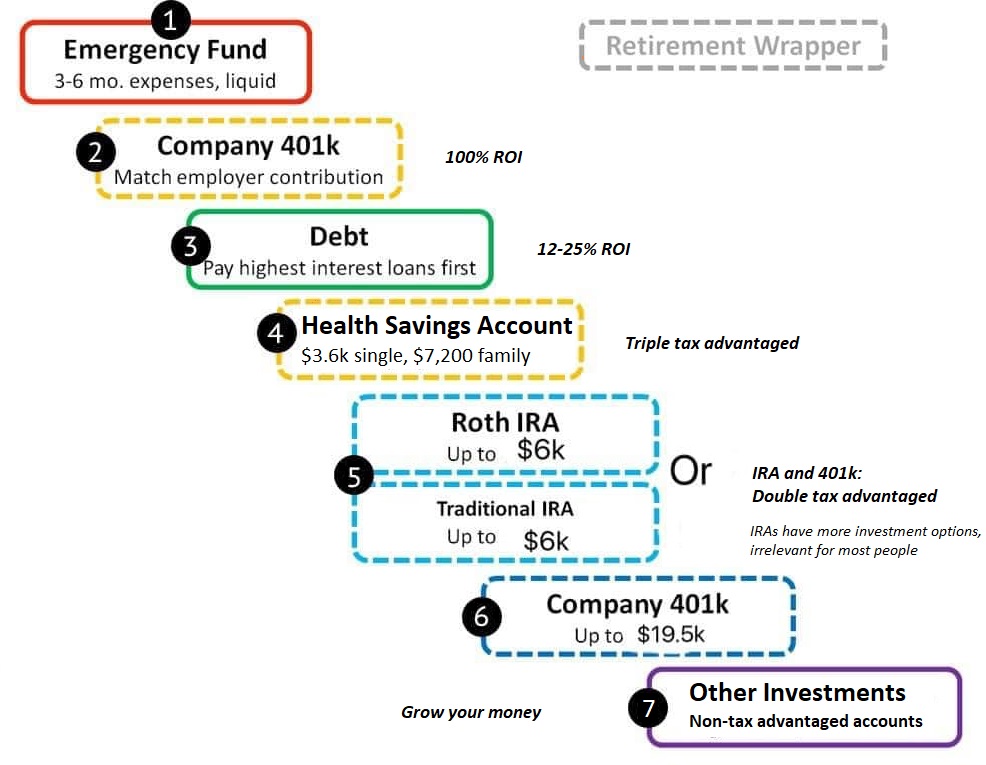

The following is the order in which I would contribute to investment accounts. Notice that retirement accounts are more valuable than non-retirement accounts (number 7 in the pic), so I wouldn’t even think about buying stocks on Robinhood if I haven’t maxed out my Roth IRA, Roth 401k, and/or my HSA for the year.

If I were starting out (20-40)…

I can speak from experience on this one. I got out of debt at 25 and saved half my income, ending up a millionaire in 11 years. I invested it all in stocks, which is what I’d recommend for this age group. I’d invest it in an index fund that tracks the S&P 500 or the whole US market. The S&P 500 has a high correlation with the total US market, so honestly, you’re fine with either one. An example of a total market index fund with low fees is Vanguard’s VTSAX.

If you prefer, you can diversify further by adding small cap stocks and/or international stocks. Small cap stocks have outperformed the S&P500 over time, but they may not do that in the future. Whatever you decide, keep a total market index fund such as VTSAX as the core of your portfolio. You may get a little higher returns (and higher risk/volatility) with small caps, but VTSAX will get you to financial independence just fine.

Mid-life (40-60)

Continue (or start) investing in stocks, but add some bonds to the mix. A well-known rule of thumb is to subtract your age from 120 and put that much in stocks. For example, if you are 50, 70 percent (120-50 = 70) should be in stocks, and 30 percent in bonds. This is what many financial planners advise.

Personally, I would plan to have 25 years’ worth of expenses in stocks, 5 years’ worth in bonds, and 3 years of cash when I retire. That’s 33 years’ of expenses, or a 3% withdrawal rate, which historically has never failed, not even for retirements of 60 years or longer. The reason for the 3 years of cash is that most bear markets recover within three years. Having a cash cushion you can use to cover your retirement expenses will keep you from having to sell when your investments are down. The first 10 years of retirement are crucial to the long term health of your portfolio, so you wouldn’t want to have to sell during a downturn within the first decade.

Traditional retirement age (60+)

At this point you should have accumulated enough assets to not have to work, and should be focusing on giving away your wealth to causes you care about, or preparing a legacy for your descendants. However, if you are just getting started at this age, your investment timeline may not afford you the risk of an all-stock portfolio. I would keep 50-80% in stocks, depending on your risk appetite. The remainder would be bonds and/or cash.

Conclusion

It’s never too early or too late to start saving for retirement. As Warren Buffett famously said, “if you don’t find a way to make money while you sleep, you will work until you die.” Our financial markets and economy have given ordinary people the opportunity to retire early, an inconceivable dream in generations past. The earlier you start, the earlier you will be able to retire, and the more you save, the faster you will get there. Reevaluate the things that cost you money and see if you’re maximizing the value of your dollars. The more you want it, the better financial habits you build, the easier it will be to buy less stuff and buy more assets. Save your money. Invest it in low cost index funds. Retire when you’ve reached your financial goal.