Your buddy just told you about a hot stock that can’t lose and will make you 10x your money. He was right about bitcoin, you have to jump in! Before you do, though, ask yourself these questions to see if you can afford to speculate in the latest bubble:

1) Are you out of debt?

2) Do you have an emergency fund?

3) Have you fully funded all your available retirement accounts for the year?

If the answer is yes, congratulations, you can afford to blow some play money on the next short squeeze. Otherwise, keep working until you can say yes to all those questions.

Debt, especially high interest debt, does you no favors. What’s the point of putting money into the market where you can hope for a 10% return while your credit card is charging you twice that? Don’t forget to have a cash cushion in case of emergency, without which you will probably have to take on more high interest debt. Finally, remember to max out all of your tax-sheltered vehicles, including:

1) IRA – $6,000 each for you and your spouse (if applicable). $7,000 if you’re over 50

2) 401k – $19,500, or $26,000 if you’re over 50

3) HSA – $3,600 if single, $7,200 for a family.

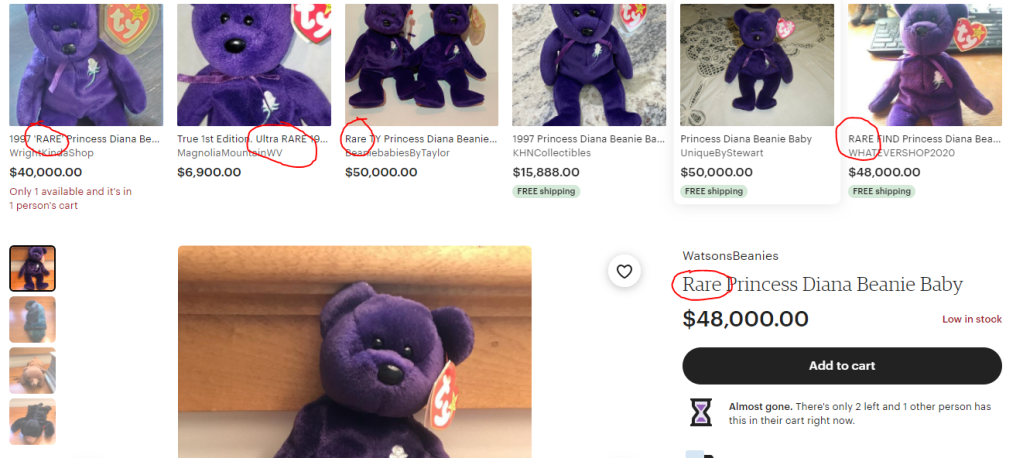

It’s also a good idea to keep the speculative part of your portfolio a small part of the whole, no more than 10 per cent. That way, if you end up losing the money, you won’t be as badly affected as if you had sunk your entire life savings into beanie babies at the peak of that bubble.