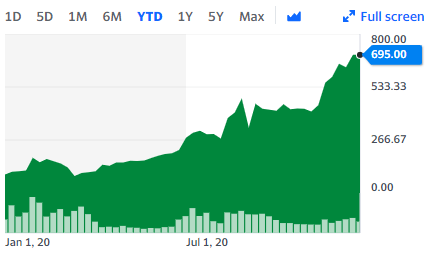

2020 has been a crazy year. I won’t go into all the weirdness that has been my life this year, but Tesla saw a meteoric rise in 2020 after five straight quarters of profitability and inclusion in the S&P 500. What that means is that every mutual fund that tracks the S&P 500 (meaning, they own all the stocks on the index) will be buying Tesla. That alone caused the stock to rise, as did people bidding up the price in anticipation.

Tesla going up 7x in a year has made CEO Elon Musk the second-richest person in the world, right after Amazon’s Jeff Bezos.

Between 2015 and 2016, I bought 50 shares of Tesla at an average price of around $200. Against my wishes, my wife later bought an additional 26 shares in her Robinhood account, bringing the total invested to about $18k. Though I’m now happy she did, at the time, I didn’t want to invest more than $10,000 into a single stock, since my investing philosophy revolves heavily around index funds.

Today, after the 5:1 stock split and meteoric rise over the past few months, that combined $18,000 investment is worth $264,000. That’s a lot of dollar bilz, y’all.